Experian Credit Reporting Misconduct — Evidence & Timeline

This notice preserves the factual record of Experian’s deceptive reporting practices impacting Circuit12.ai, LLC and its managing member. All statements are supported by exhibits below (screenshots and payment confirmations). This page will remain online for transparency and evidentiary purposes.

Evidence Timeline

- Aug 17, 2025: Experian score at 669. (Pre-purge baseline.)

- Aug 18, 2025: Experian deletes Frontier bill; app banner claims “+9” while dashboard shows 664.

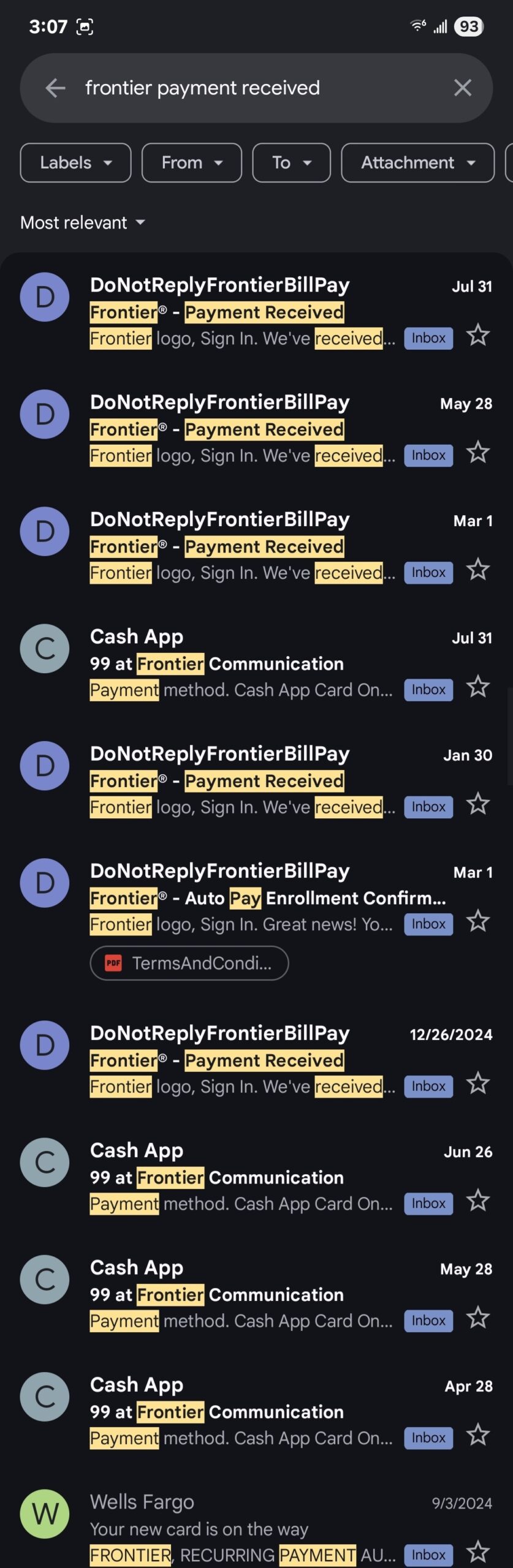

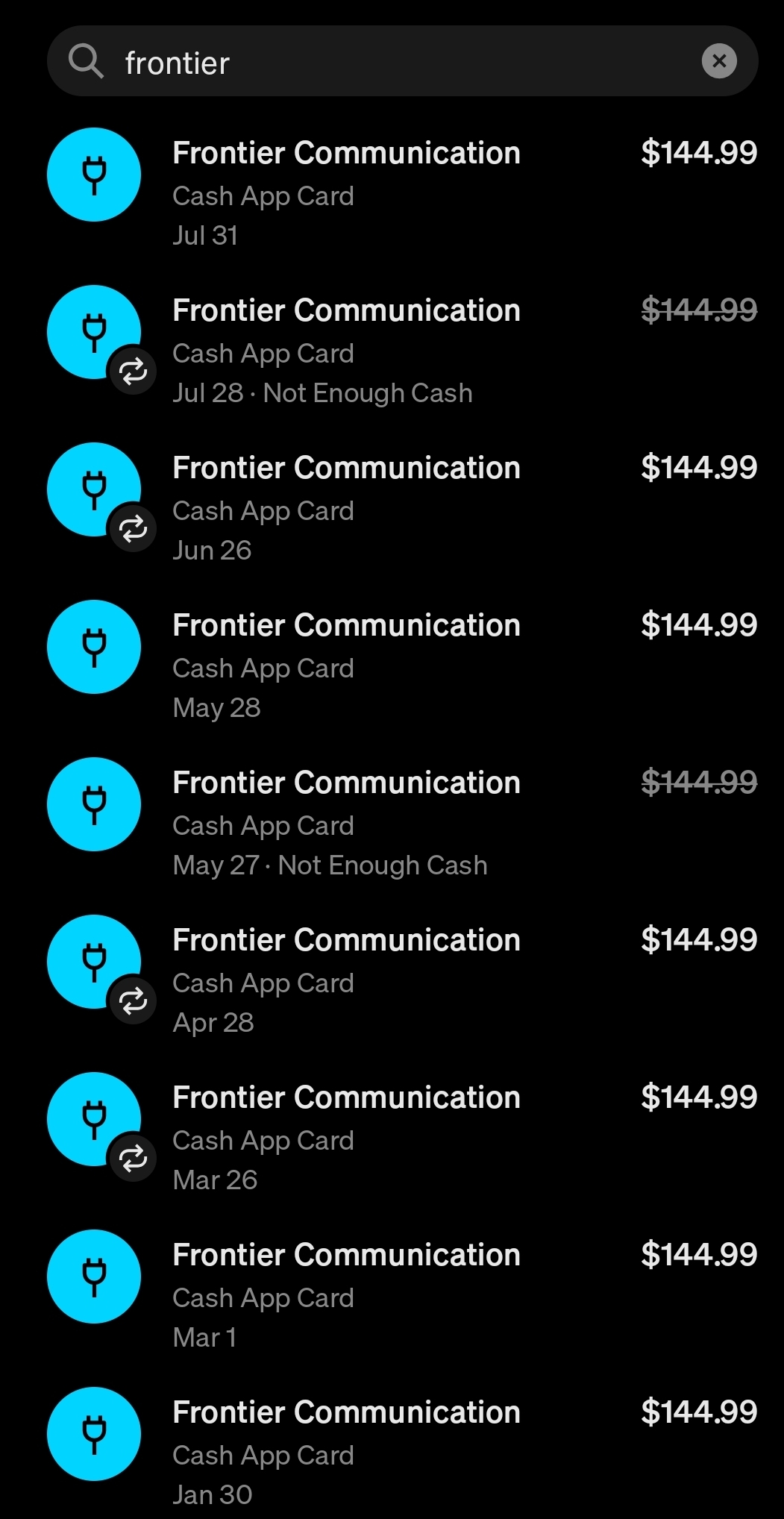

- Aug 18–20, 2025: Frontier payment notification + Cash App proof confirm the account is current.

Contradiction: Experian’s claimed “increase” is disproven by the numerical record (669 → 664). The purge removed a positive, active tradeline while misrepresenting the impact to the consumer.

Exhibits

Experian displayed a “+9” increase while the dashboard showed a lower score than the prior day.

Baseline immediately preceding the purge.

Provider notification showing the bill was paid and the account is current.

Remittance record corroborating timely payment of the Frontier bill.

Regulatory & Legal Posture

Regulatory

- Referred to federal and state authorities for review consistent with recent enforcement activity.

- Pattern indicates deceptive presentation of score changes and improper purge of active tradelines.

Commercial Harm

- Interference with trade and reputational injury at the entity level.

- Operational risk via cross-contamination into business credit pipelines.

Disclosure & Legal Notes

Truthful record: All statements herein are based on contemporaneous screenshots, provider notifications, and remittance proofs. Images are originals or direct exports from first-party systems.

Purpose: Preservation of evidence and transparency for regulators, partners, and the public.

No legal advice: This publication is not legal advice and does not create an attorney-client relationship.

Updates: This page may be updated to append additional timestamps or exhibits as needed.