Public Notice of Record — Experian Misconduct

This is the first entry in a permanent public archive hosted by Circuit12.ai, LLC documenting

discrepancies, sham reinvestigations, data purges, and consumer/business harm by the national credit bureaus

(Experian, Equifax, TransUnion). This page is a model record with exhibits.

A multi-bureau submission hub will follow; until then, contact us directly via the button below.

✉ Email: info@circuit12.ai

How to submit (guidance)

Broader FCRA Compliance Review

This documented case is not an isolated incident. It represents one example of multiple

Fair Credit Reporting Act (FCRA) compliance failures currently under

internal review by Circuit12.ai, LLC.

- Other disputes involve disputed purges of active, positive tradelines.

- Evidence indicates repeated score manipulation through contradictory reporting (e.g.,

claiming increases while actual scores decline). - Cross-contamination between personal and business credit profiles has been observed in

preliminary analysis.

Additional examples are being archived and will be posted in subsequent updates to this page.

All evidence will be consolidated for potential referral to federal and state regulators

alongside civil remedies.

The Current Case Study

Experian removed an active, paid Frontier tradeline and displayed an in-app banner claiming a

“+9 point increase.” The numerical record shows the opposite: 669 → 664 within ~24 hours.

Evidence is preserved below.

Evidence Timeline

- Aug 17, 2025: Experian score 669. (Baseline.) —

- Aug 18, 2025: Experian deletes Frontier bill; banner claims “+9”, dashboard shows 664. —

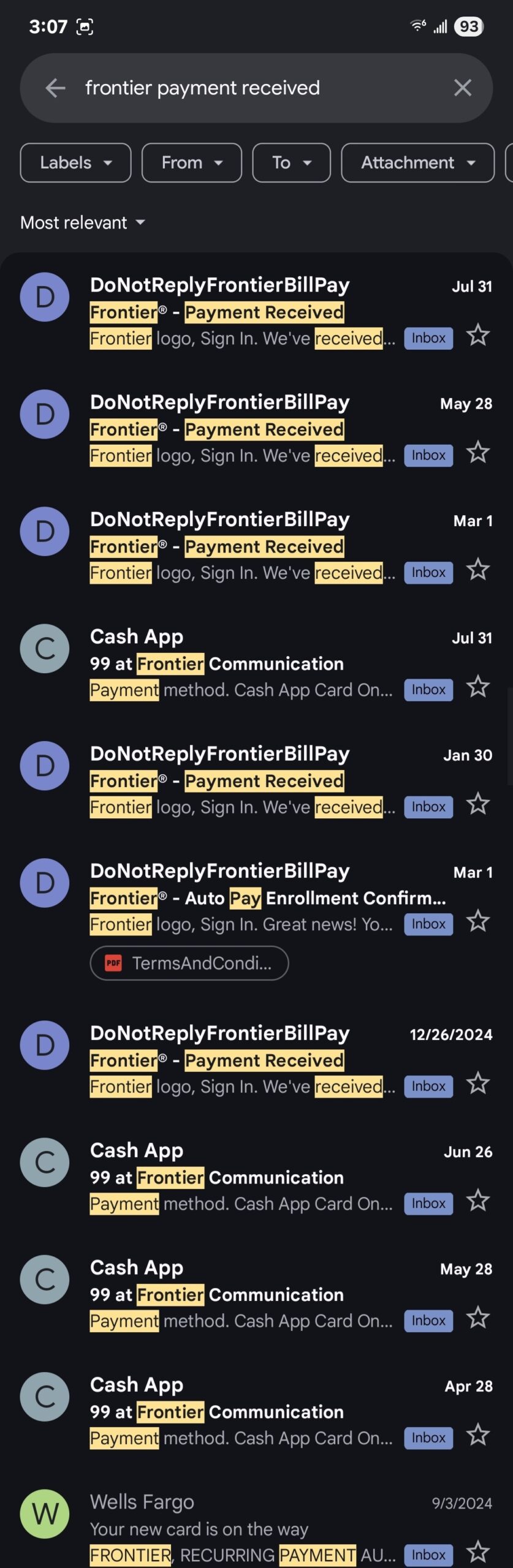

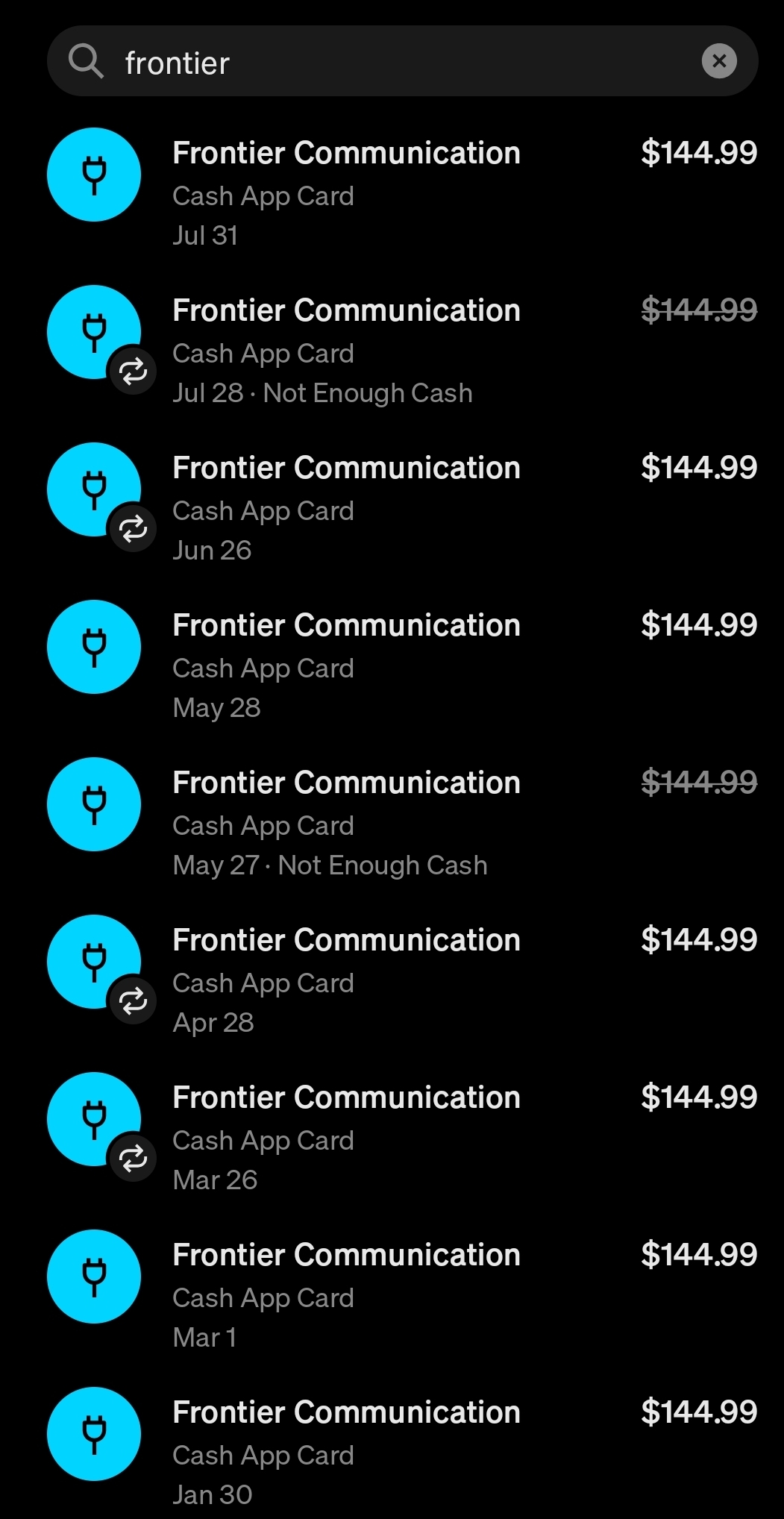

- Aug 18–20, 2025: Frontier & Cash App confirmations show the bill was paid/current. —

Exhibits (tap to expand)

Exhibit A — Score 664 with “+9” Claim (Aug 18, 2025)

Exhibit B — Prior-Day Score 669 (Aug 17, 2025)

Exhibit C — Frontier Payment Confirmation (email)

Exhibit D — Cash App Remittance Proof

Public Submissions (beta)

Circuit12.ai is standing up dedicated sections for Experian, Equifax, and TransUnion.

While the beta intake form is finalized, contact us by email with your documented case and exhibits.

Regulatory & Legal Posture

- Status (current): This record is being prepared for potential submission to federal and state authorities. If and when formal referrals are filed, this page will be updated with the filing dates and references.

- Documented conduct: The exhibits show an active tradeline was removed while an in-app banner claimed a “+9” increase despite a net 5-point drop (669 → 664).

- Potential downstream impact: Based on the documented behavior, removal/misreporting of a positive tradeline can influence personal scores and, where applicable, may propagate into business credit evaluations. We are monitoring and will append additional evidence if downstream effects occur.

- Reservation of rights: Circuit12.ai, LLC reserves all rights to pursue administrative complaints, civil claims, and media disclosures should corrective action not occur.

Disclosure & Legal Notes

Truthful record: All statements are based on contemporaneous screenshots, provider notifications, and remittance proofs.

Purpose: Preservation of evidence and transparency for regulators, partners, media, and the public.

No legal advice: This publication is not legal advice and does not create an attorney-client relationship.

Updates: This page may be updated to append additional timestamps or exhibits.